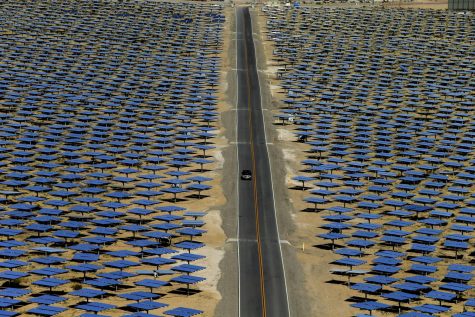

How Trump’s tariffs could help — or hammer — one beleaguered segment of the U.S. solar industry

February 1, 2018

WASHINGTON — Much of the U.S. solar industry is slamming President Trump’s decision to slap a 30 percent tariff on solar equipment made outside of the United States. But Trump’s confrontational approach has provided a glimmer of hope for U.S.-based companies that make polysilicon, a key component of solar panels.

In 2013, China imposed hefty tariffs on U.S.-made polysilicon, retaliation against the tariffs President Obama levied on Chinese-made solar panels a year earlier. The Chinese tariffs wiped out the business of companies such as REC Silicon, a Norwegian company that runs a solar-grade polysilicon plant in Moses Lake, Wash., which once employed more than 500 people.

Francine Sullivan, vice president for business development at REC Silicon, said her company is no fan of tariffs, but is encouraged that the Trump administration has agreed to negotiate with China on a resolution to longstanding solar trade issues.

“What we need is for them to execute on that commitment as soon as possible,” said Sullivan. “This industry has been absolutely battered by these prolonged trade disputes.”

Hemlock Semiconductor, the other large U.S. manufacturer of polysilicon, also applauds efforts to seek a resolution with Beijing. “Restoring U.S. polysilicon producers’ access to China through such a settlement will preserve and expand U.S. jobs, unleash significant U.S. export capacity while reducing the trade deficit with China,” Hemlock said in a statement.

In 2014, Hemlock was forced to close a new polysilicon plant in Clarksville, Tenn., because of the Chinese tariffs. The company laid off roughly 500 workers. Also lost was $343 million worth of public investment in the plant.

Trump’s tariff has divided the solar industry and triggered rebukes from even Republican governors whose states have stakes in the industry. Companies that sell solar power systems fear the panels and equipment they import will suddenly get more expensive.

But for REC Silicon and Hemlock, U.S.-China talks could be a game changer.

Up until 2013, the two companies accounted for nearly one quarter of worldwide production in polysilicon, the main feedstock in the production of photovoltaic solar cells. The process of making polysilicon is fairly energy-intensive, one reason that U.S. companies based their plants in states such as Washington and Tennessee, which enjoy cheap electricity courtesy of federal energy projects.

According to REC Silicon, the company invested $1.7 billion in 2010 in its Moses Lake plant, with the bulk of its production aimed at the Chinese market. After China imposed a 57 percent tariff on U.S. polysilicon, the company couldn’t compete in China, and lost roughly 80 percent of its business. Over the last three years, REC Silicon has laid off hundreds of workers in central Washington and at another plant in Butte, Montana.

In recent weeks, representatives from polysilicon makers have met with U.S. trade officials, including Robert E. Lighthizer, the president’s chief trade negotiator, and urged them to negotiate a settlement with China that would restore their access to the Chinese market.

REC Silicon’s remaining 400 employees in Washington and Montana also sent Trump a Jan. 9 letter urging the same. “Seeing our co-workers lose their jobs has been wrenching, but now the remaining jobs are at risk if this crippling dispute is not resolved soon,” the workers wrote to Trump.

Trump campaigned on protecting U.S. manufacturing jobs and cracking down on China’s trade policies, which he called “one of the greatest thefts in the history of the world.” The tariffs approved Monday are aimed largely at Chinese solar panel manufacturers, which responded to the Obama-era tariffs by shifting much of their production to other parts of Asia.

Although polysilicon makers hope that Trump’s new tariffs will force China to the bargaining table, there’s alsoa chance it will harden Beijing’s position, and prompt further retaliation. China has not yet stated how it will respond, other than saying it will protect its legitimate interests.

“Protectionism is a double-edged sword,” foreign ministry spokeswoman Hua Chunying told a daily news briefing in Beijing on Wednesday. “It not only wounds others but wounds themselves.”

At the World Economic Forum in Davos on Wednesday, U.S. Commerce Secretary Wilbur Ross shot back at China’s messaging. “The Chinese for quite a little while have been superb at free-trade rhetoric and even more superb at highly protectionist behavior,” Ross said during a Davos panel session. “Every time the U.S. does anything to deal with a problem, we are called protectionist.”

Even if the two sides resolve their solar disputes, China has spent the last three years building up its own polysilicon industry, making it harder for U.S. companies to regain the access to the market. Hedging its bets, REC Silicon in 2014 entered into a joint venture with a Chinese company, Shaanxi Non-Ferrous Tian Hong New Energy Co., Ltd., to build a polysilicon plant in China.

Many industry analysts say U.S. job losses will exceed gains if Trump’s tariffs on foreign solar panels remain locked in place. The tariffs will drive up costs for solar installation companies that import solar panels, costing them business. According to estimates by the U.S. Solar Energy Industries Association (SEIA), the tariffs will eliminate 23,000 jobs.

Of the roughly 260,000 solar jobs nationwide, only 38,000 are in manufacturing, according to the SEIA.More than 100,000 people are employed in solar businesses in California and another 3,681 work in Washington state, according to the trade association.

Sullivan said she remains hopeful that the United States and China will broker a resolution instead of resorting to more tit-for-tat tariffs.

“We don’t think tariffs lead to good outcomes for U.S. interests,” she said. “We think there should be free trade in solar products.”